STAMP DUTY is applicable. Its tax time again which means a couple of things if you trade shares in Malaysia.

Instarem Raises 5m To Make Overseas Money Transfers Cheaper And Faster In Asia Forex Brokers Forex Investing

Procedures to Transfer of Shares of Malaysian Company.

. Depending on the amount purchased the businessmen can become minority or majority shareholders. For simplicity this article assumes that the business is owned and conducted using a private limited company that is not listed on a stock exchange ie a Sendirian Berhad. Under the Real Property Gains Tax Act 1976 RPGT Act an RPC is a controlled company which the defined value of its real property or shares in another RPC or both is at.

Whether youre a trader or investor this guide explains how much. Although capital gains are generally not taxed in Malaysia one exception to this is the gains arising from the disposal of either real property OR shares in a Real Property Company RPC. Shares or stock listed on Bursa Malaysia.

Consideration Sum in words. By returning to the shareholders any paid-up share capital which is in excess of the needs of the company. For that once the directors had made up their mind in shares transfer.

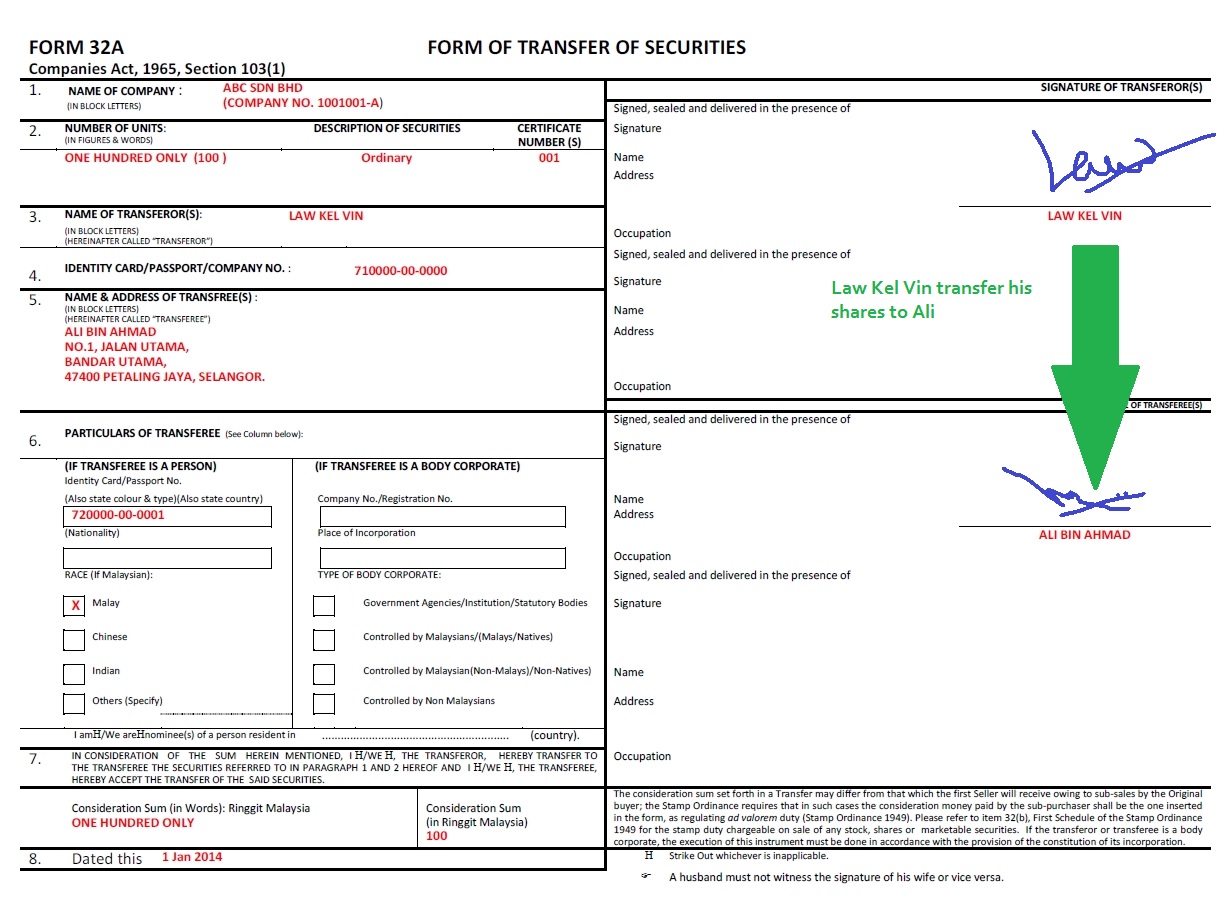

The transfer of shares in Malaysia has to be completed following the provisions stated by the Companies Act Section 103. The approval of the collector of stamp duties is required and anti-avoidance provisions under section 15 may claw back the stamp duty relief if granted under certain. The following are step-by-step guide for the transfer of shares in a company.

The issue of shares when shares are to be acquired in the transferee company to the holders of shares in the existing company in exchange for the shares held by them in the existing company. Service Agreements and Loan Agreements. A share is a security which represents a portion of the owners capital in a business.

A transfer of shares is prescribed under section 1051 of CA 2016. Shares buyer to transfer the money to the shares seller directly. The section states that subject to other written laws any shareholder may transfer all or any of his shares in the company by a duly executed and stamped instrument of.

The stamp duty payable is therefore calculated based on par value ie. Stamp duty of 05 on the value of the services loans. In Malaysia the Companies Act 2016 CA 2016 recognises the distinction between transfer and transmission of shares.

Actual Value RM450 Shareholders Fund divided by total shares The stamp duty for transfer of 50000 ordinary. Instruments of transfer implementing a sale or gift of property including marketable securities meaning loan stocks and shares of public companies listed on the Bursa Malaysia Berhad shares of other companies and of non-tangible property eg. A company is having 100000 ordinary shares with its par value at RM100 each.

Stamp duty for transfer of shares Malaysia Section 1051 of the Companies Act 2016 required any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. Information to include in the form are.

Value of shares transferred RM091 x 150000 RM136500 C Sale consideration RM75000 A comparison between Par Value NTA and sale consideration shows that the value of shares based on par value is the highest. Boards Resolution Approval from the Board of Directors to accept the transfer of shares. Before shares can be transferred the shareholder must inform the company director.

The calculation of the shares value will be as follows. Book debts benefits to. Finally the SECTION 105 FORM will be delivered to.

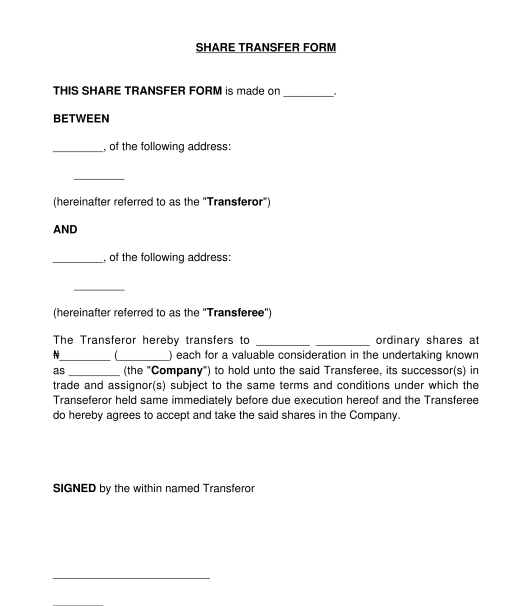

In order to transfer shares in a sdn bhd company from one person to another person in Malaysia the following documents are needed to complete the shares transfer. Regardless of the size of your business there are two common ways to sell a business either via a share sale or an asset sale. In consideration of the sum herein mentioned IWe the Transferor hereby transfer to the Transferee the securities referred to in paragraphs 1 and 2 hereof and IWe the Transferee hereby accept the transfer of the said securities.

The 10-page 2019 Guidelines replaced the earlier Guidelines on the Stamping of Share Transfer Instruments for Shares that are not quoted on the Kuala Lumpur Stock Exchange 2001 Guidelines and were effective from 1 June 2019 until 29 February 2020. Ringgit Consideration Sum In Malaysian Ringgit RM 8. All transfer of shares are subject to approval from the Board of Directors.

Once the director acknowledges the transfer the shareholder is required to complete Form 32A. Shareholders are the owners of the business and share the success or failure of the business. That company is having total shareholders fund of RM450000 as at the end of last year.

Par Value RM100. Section 105 FORM OF TRANSFER OF SECURITIES. The performance of the business can often be measured by the amount of dividends shareholders receive and by the price of the share quoted on the stock market.

Secretary to prepare board resolution Form 32A The Company Secretary will at the request of the directors to prepare the Board Resolution for directors to approve the transfer of shares and the Form 32A to be signed by existing shareholder new shareholder for the relevant shares to be. The Share Transfer Form Form 32A need to be witnessed by someone not wife or husband The shareholders need to pay stamp duty for the shares transfer The stamping on Form 32A will be done at any LHDN office. The new 13-page 2020 Guidelines which are effective from 1 March 2020 replace and cancel the 2019 Guidelines.

Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be eligible for a tax exemption. For shares transfer stamp duty will be calculated by 1 by LHDN and upon completing the process the authority LHDN will be generating a stamping certificate as a proof or cleared payment.

Don T Forget Cricut Supplies Card Stock Heat Transfer

The Pros And Cons Of Freehold And Leasehold Property Freehold Investment Property Things To Come

Transfer Of Shares In A Real Property Company Donovan Ho

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Rasa Malaysia Giovanni S Shrimp Scampi Copycat Recipe Couldn T Navigate The Website Through All The Pop Recipes Shrimp Recipes For Dinner Shrimp Scampi Recipe

Transfer Of Shares Company Share Transfer Legalraj Com

Mexican Hot Chocolate Brownies Bird Bakery In San Antonio Mexican Hot Chocolate Brownies Hot Chocolate Brownies Mexican Hot Chocolate

Form 32a Share Transfer Form Company Registration In Malaysia

Contactless Mobile Payment Mobile Payments Logo Online Shop Concept Art Characters

Suren Holidays International Travel Destinations Travel Hotels Tour Packages

Share Transfer Procedure In Private Limited Company Ebizfiling

Freehold Vs Leasehold Freehold Common Myths Home Buying Tips

Sample Letter Of Intent Letter Of Intent Letter Example Letter Sample

Share Transfer Form Sample Template Word And Pdf

Craft Tip Use Fabric Crayons To Transfer And Duplicate Patterns The Zen Of Making Sewing Techniques Sewing Hacks Sewing Tutorials

Van Aken Kato Polyclay White 12 5 Oz Block Etsy In 2022 Kato Polyclay Color Mixing Kato

Pin By Allison Gagnon On Skinny Betch Fish Fillet Winter Squash Squash Noodles

Latest Market Research Reports On Top Industries Aarkstore Com Retail Banking Banking Marketing